XRP Price Prediction: 2025-2040 Forecast Analysis

#XRP

- Technical indicators show XRP at critical support levels with mixed signals

- Regulatory developments and ETF approvals are near-term price catalysts

- Long-term growth depends on adoption in cross-border payments and Islamic finance

XRP Price Prediction

XRP Technical Analysis: Key Levels to Monitor

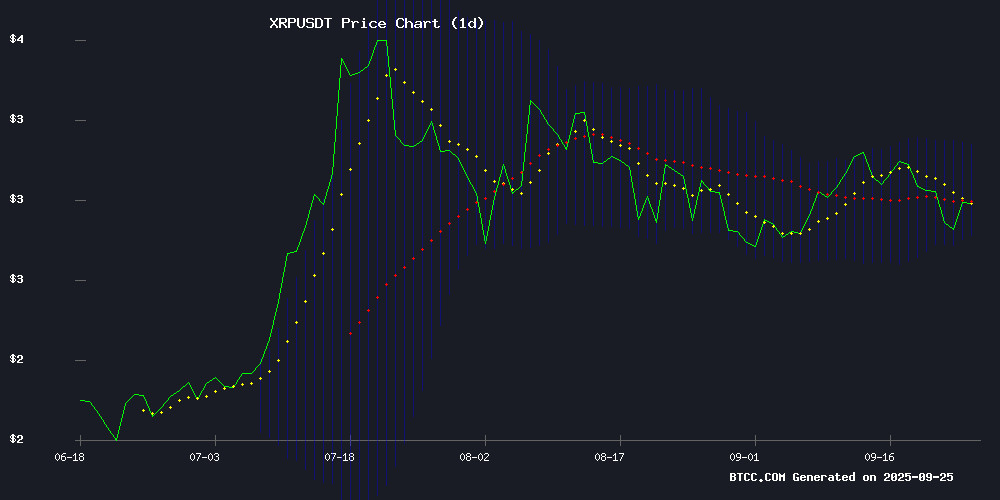

XRP currently trades at $2.7554, below its 20-day moving average of $2.9683, indicating potential short-term bearish pressure. The MACD histogram shows a positive reading of 0.0451, suggesting some bullish momentum may be developing. However, the signal line remains negative at -0.0690. Bollinger Bands position the current price NEAR the lower band at $2.7702, which could act as support. According to BTCC financial analyst Emma, 'The technical setup shows XRP at a critical juncture. A break above the 20-day MA could trigger momentum toward the upper Bollinger Band at $3.1663, while failure to hold the lower band support might lead to further downside.'

XRP Market Sentiment: Regulatory Clarity and Adoption Drive Optimism

Recent developments including XRP Ledger expansion with spot ETFs, EVM sidechain integration, and Shariah compliance certification in Bahrain are creating positive sentiment. The countdown to ETF approval and growing institutional adoption are key catalysts. BTCC financial analyst Emma notes, 'The combination of regulatory clarity post-legal battles and expanding real-world utility positions XRP for potential long-term growth. The market may be underestimating the supply dynamics as highlighted by recent commentary about limited available XRP.'

Factors Influencing XRP's Price

XRP Ledger Expands with Spot ETFs, EVM Sidechain and Global Events in 2025

The XRP Ledger (XRPL) has emerged as a formidable force in the crypto landscape in 2025, fueled by legal clarity and institutional adoption. With Ripple's SEC lawsuit resolved, XRP's classification as a non-security paved the way for spot ETFs from Grayscale Investments and REX-Osprey, injecting liquidity into the market.

Technological innovation surged with the launch of an EVM-compatible sidechain, which onboarded 1,400 smart contracts within its first week. The network's total value locked (TVL) skyrocketed to $120 million shortly after, signaling robust developer activity.

Global momentum became undeniable as XRPL hosted 19 international events, reflecting growing community engagement. The convergence of regulatory certainty, institutional products, and scalable infrastructure positions XRP as a blockchain with rare trifecta of adoption drivers.

Pundit Says People Don’t Realize How Little XRP is Left, Here’s Why

An XRP community pundit claims market participants are underestimating the scarcity of XRP's available supply. Ripple Van Wickle asserts nearly half of the total supply has been allocated to Ripple, its founders, and early institutions.

The commentary highlights a growing disconnect between perceived and actual liquidity in the XRP market. Such supply dynamics could have significant implications for price discovery and long-term valuation.

XRP Price Prediction: Will Ripple’s Next Breakout Send It Surging Past $10?

Ripple's XRP is stirring fresh debate in crypto markets as its price hovers near $2.90, with analysts divided on whether the token can breach double-digit territory. The payments-focused blockchain continues expanding its network of financial partners, reinforcing its utility in cross-border settlements—a factor that has sustained interest through multiple market cycles.

While optimists point to Ripple's growing institutional adoption, skeptics highlight XRP's large circulating supply and historically slow recoveries. Traders seeking higher-risk opportunities are simultaneously eyeing emerging tokens like Layer Brett (LBRETT), which some speculate could outperform even a potential XRP rally.

The token remains far below its 2018 peak, leaving long-term holders watching for a decisive breakout above $5. Ripple's real-world use cases in replacing legacy payment rails continue to anchor its value proposition, distinguishing it from purely speculative assets.

3 Penny Stocks to Watch Highlight XRP Adoption Push

Datavault AI leads active penny stocks with $357 million volume amid 12% pullback following an 80% rally. The AI data firm partnered with Nature's Miracle and Harrison Global to accelerate XRP ecosystem adoption, triggering recent volatility.

Penny stock traders focused on the Web3 sector as TipRanks' screener identified high-volume opportunities under $5. While speculative, these micro-caps show unusual institutional interest - Datavault's collaboration signals growing enterprise blockchain integration.

Crypto Pundit Dismisses Need for LLC to Hold XRP Amid Tax Confusion

Vincent Scott, a widely followed crypto commentator, has refuted claims that investors require a limited liability company (LLC) to hold XRP due to tax concerns. In a recent video, Scott asserted, "You do not need an LLC to hold XRP, and that’s false." The clarification comes as misinformation circulates about potential tax implications tied to XRP ownership.

Scott’s remarks aim to cut through the noise, emphasizing simplicity for retail investors. The debate highlights recurring confusion around crypto taxation—a pain point regulators have yet to fully address. XRP’s legal clarity following Ripple’s partial victory against the SEC hasn’t spared it from ancillary market myths.

XRP Price Prediction and DeepSnitch AI Presale Gain Traction Amid Market Volatility

XRP surged past $3 following the Federal Reserve's rate cut announcement, only to retreat below this threshold by September 23rd. Market analysts attribute the pullback to fading momentum across crypto markets, though expectations of additional rate cuts and potential XRP ETF approvals could reignite bullish sentiment.

Technical indicators suggest an impending breakout, with traders accumulating XRP at current levels near $2.8. The anticipated October decision on spot XRP ETFs looms as a potential catalyst for price recovery.

Meanwhile, the DeepSnitch AI presale has attracted $228K in its initial phase, drawing attention as a high-potential altcoin play. Early investors speculate about 100x returns, where a $500 position could yield $50K if the project delivers on its trader-focused utility promises.

XRP Gains Shariah Compliance Certification in Bahrain, Expanding Islamic Finance Reach

Bahrain's Central Bank has officially certified XRP as Shariah-compliant through its Shariyah Review Bureau, marking a strategic milestone for Ripple's digital asset. The approval positions XRP for accelerated adoption in Gulf remittance markets and cross-border payment solutions across Islamic finance jurisdictions.

The certification validates XRP's alignment with Islamic ethical principles—particularly the prohibition of interest (riba) and excessive speculation. This unlocks access to trillion-dollar markets in Bahrain, Saudi Arabia, and the UAE, where financial products require strict religious compliance.

Ripple's infrastructure now stands to benefit from heightened institutional credibility in regions dominating Islamic finance. Analysts note the timing coincides with growing Gulf-state interest in blockchain-based settlement systems that adhere to Shariah law.

XRP Emerges as a Potential Solution to the Global Debt Crisis

Versan Aljarrah, founder of Black Swan Capitalist, posits that XRP could address the escalating global debt crisis by converting trillions in debt into blockchain-based assets. The International Monetary Fund reports global debt surged to $251 trillion in 2024, with U.S. public debt at 121% of GDP and China's at 88%. Aljarrah argues XRP, alongside tokenized gold and regulated stablecoins, could unlock liquidity trapped in systemic debt.

Meanwhile, crypto analyst EGRAG Crypto projects XRP could reach $15 to $33, reflecting growing institutional interest in tokenization as a debt restructuring tool. The financial sector increasingly views blockchain-based solutions as viable for mitigating unsustainable debt burdens.

XRP Price at Critical Turning Point – Key Levels to Watch on September 25, 2025

XRP faces a decisive moment as it tests critical support and resistance levels. The $2.95 mark has emerged as a near-term ceiling, with repeated failures to sustain momentum above the $2.90-$3.00 range. A breakthrough above $3.35 could signal the start of a significant rally, according to analysts.

On the downside, the $2.80-$2.85 zone offers immediate support, backed by converging trendlines. A breach below this level could see XRP test stronger support at $2.70, with $2.60 acting as the next line of defense. Market sentiment and external factors remain key drivers for XRP's next move.

XRP Investment Outlook Post-Legal Clarity

XRP's legal clarity following the August 2025 SEC settlement has improved its investment appeal, though volatility remains a key factor. Trading near $2.84 with a $170 billion market cap, the token faces resistance around $3.3, with mixed momentum indicators signaling potential whipsaws.

The resolution of Ripple's $125 million penalty has spurred institutional interest, but adoption hurdles persist. Banking integration and contract changes will dictate the pace of real-world use, making XRP a high-risk, high-reward proposition for now.

XRP Price Speculation Intensifies as ETF Approval Countdown Begins

Market participants are closely monitoring XRP's price trajectory as industry experts suggest a potential spot ETF approval could materialize within weeks. The cryptocurrency, which has weathered regulatory challenges in recent years, now faces a pivotal moment as institutional adoption mechanisms gain traction.

Reuters' confirmation of advanced U.S. regulatory discussions has injected fresh optimism into XRP markets. Historical precedent suggests ETF approvals typically catalyze short-term price appreciation, though sustained rallies depend on broader market conditions and liquidity flows.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, XRP's price trajectory appears cautiously optimistic. For 2025, the key resistance level at $3.1663 needs to be breached for sustained upward momentum. The ETF approval process and broader crypto market conditions will be critical determinants.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.50-$4.00 | $4.50-$6.00 | $7.00-$10.00 | ETF approvals, regulatory clarity |

| 2030 | $8.00-$12.00 | $15.00-$25.00 | $30.00-$50.00 | Mass adoption, cross-border payments |

| 2035 | $20.00-$35.00 | $40.00-$75.00 | $80.00-$120.00 | Institutional integration, DeFi growth |

| 2040 | $50.00-$100.00 | $120.00-$200.00 | $250.00-$500.00 | Global financial infrastructure role |

BTCC financial analyst Emma emphasizes that 'These projections assume successful execution of Ripple's expansion plans and favorable regulatory environments. The EVM sidechain development and Islamic finance certification could significantly accelerate adoption timelines.'